Inflation, as it turns out, isn’t transitory. Not even close. It doesn’t instill much confidence that those on the Federal Reserve committee didn’t predict that 2 years (15 years!) of loose monetary policy would come home to roost. As a result, Jerome Powell, the Federal Reserve and anyone that owns assets has some deep thinking to do because it doesn’t look pretty.

Sadly, over the past 15 years, the Federal Reserve has enabled a culture of rampant speculation and borrowing. They bailed out companies in 2008 who’s risk management should have led to their failure (and recall that TARP was only $700 billion) and the result was to undermine risk/reward capitalism. Not surprisingly, the response has been growth in private and public debt in the U.S. to over $87 trillion, roughly $50 trillion more than in 2007. It’s a super charged house of cards and the horses left the barn a long time ago.

What happens if interest rates go to 3%? 5%? 10%? If we finally get the recession we deserve, delayed from Government policy enacted as a result of THEIR RESPONSE to COVID, does the Fed have any bullets to save us from ourselves? Equally, when did the Fed’s mission creep beyond inflation and full employment?

In today’s HTOYC, I share a 12 minute segment of my conversation with Richard Norris on why high energy prices are intrinsically inflationary. Related, I pose this question to readers to muse over: if oil and natural gas prices are high because of a fundamental under supply resulting from 2 years of low capital investment, profitability and now sanctions on Russia reducing supply, can raising interest rates slow demand enough across the economy to address what is a supply driven shortage? And if so, how high do they have to go to make an impact?

Here’s what I’m thinking about.

In April 2020, there is no doubt I was too bearish in the short term. The fault in my thinking lies with my mistake that I thought the politicians and bureaucrats would be thoughtful in their policy decisions.

In a magical parallel universe of my own making, where the smartest people I know, none of whom are career politicians, would have got in a room and scenario planned, we would have averted the disaster Jerome Powell and crew face today. Yes, it would have been painful. The S&P would probably be about the same level it was in February of 2020 (~3400), unemployment would be in the range of 6%, inflation would be perpetually low and your house would be worth 4-6% more than it was in March 2020.

Ultimately, the same number of people likely would have died of/with COVID but overall, I’ll make the bold prediction we would have seen less all cause mortality deaths. We would have had less alcohol related deaths (there were 74,000 in 2020 in the age group of 16-64, 6,000 more than of/with COVID in the same age bracket). We would have had less overdose related deaths, where in 2021 the U.S. exceeded 100,000, up from 10,000 at the turn of the century.

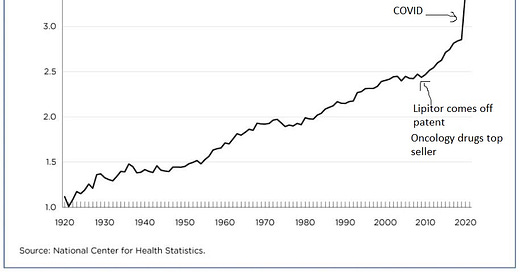

On the topic of death, I’ve always found this graph fascinating. Despite the same rate of population growth in the US, something happened in 2010 to dramatically change the slope of the deaths from 2010-2020 as compared to 1975-2010. I believe it’s more pharmacological intervention- sick care over health care - but time will tell.

Most importantly in this parallel universe, we would have avoided the health issues we are going to experience in the coming decade. Isolation increased depression and anxiety, especially amongst kids. We ruined 2 years of education for many kids in high school and college. And worst, 42% of Americans wouldn’t have gained the 29 lbs they did, which will lead to numerous health problems in the future. We are already a fat country and it just got a lot worse.

I am, of course, speculating as this parallel universe doesn’t exist. But, truly, if it did, the core rule of that world would be that you can’t restrict life and the ability to live freely, for any reason, ever. I hope we remember this during the next pandemic.

At the core of humanity, I believe that all people are wired to behave in their own self interest. In March 2020 as this new virus made it’s way around the world, stadiums and restaurants were half empty BEFORE lockdowns. The government didn’t need to do anything but educate.

As data came out about who was at risk and who wasn’t, citizens would make their own decisions that served their best interests and “the market of behavior” would have got it right. If you were afraid or nervous, you would have stayed home. As you got more comfortable with your own risk, you would have rejoined society and behavior, not policy, would have dictated the duration of the pandemic.

What should have happened was that “14 days to flatten the curve” should have been just that. The economy should have reopened at Easter and the vulnerable (over 65, significantly obese and immunocompromised) should have been added to “protected class status” where they could work from home and be supported by their communities. And as a nation, we should have been fat shaming the f@&k out of people who’s personal decisions made them inherently at higher risk to COVID. The young people (so schools and most of the workforce, 62.7% of the workforce is below 50) should have all been sent out out in the world to treat COVID like the chicken pox, build natural immunity and the result would have kept the hospitals more or less empty. So Sweden, with less blond people. With respectful seniors store hours and the ability to wear a mask if you chose, we would have experienced some pain, but not the super charged build up “House of Pain” we are about to experience. Trade offs are a thing, and the Piper is calling.

Instead, medical experts who didn’t understand the economy said “Shut everything down!” Economists, who didn’t understand anything about medicine said “OK, well, we are going to need an incredible amount of stimulus.” And politicians, who only care about the next election said “That sounds great guys, let’s do it, we have an election to win!” So we got was PPP loans round 1, then round 2, stimmy checks to everyone (myself included!), eviction moratoriums, student loan moratoriums, infrastructure bills and the worst, most insane part? The Federal Reserve bought Mortgage Backed Securities to the tune of $40 billion a month and Treasuries to the tune of $80 billion a month to keep rates artificially low. They apparently missed that house prices were up 40%+ and that market didn’t need any more stimulus.

My mistake was that I simply did not believe that central banks would open the money printing taps and print as though there would be no ramifications. I should have known better. Since 2007, Central banks around the world have added $25 trillion of new cash to the system and low interest rates have led to rampant speculation with little ramifications for bad lending decisions. And by restricting normal daily activities, the ability to work, socialize and consume, we artificially broke supply chains which took decades to build. In short, we shot ourselves in the collective foot.

Bankers and traders took advantage of it as loose monetary policy and interest free money pushed trillions into the S&P, which is now up 33% from pre pandemic highs. Traders could wildly speculate on commodities and meme stocks, both because we depleted the inventory of most commodities over 2 years and because money was free, risk was cheap and the casino was open.

The results are in and inflation is 7.9%, though realistically this understates the real number. The 10 year treasury is already at 2.6% and, even more surprising perhaps, the 30 year mortgage rate is over 5%. And the Fed has only raised interest rates 25 basis points so far.

Tightening credit will slow the housing market. It will make servicing debt more expensive. And it should reduce the value of stocks and bonds (yields will rise, though). 65% of the average American family’s net worth is in home equity. Rising equity floats the economy but as we saw in 2007, when interest rates rise, families can’t refinance their house to use that home equity for outspending their income on things like vacations, cars, kids tuition and new iPhones.

As stretched buyers try to refinance their homes in a rising interest rate environment, some will default. Others will sell and downsize. The incredibly tight housing market today softens. House values fall, people feel poorer, they spend less and as demand falls, unemployment rises, companies become less profitable and the economy shrinks.

Government and pharmacological intervention didn’t stop COVID. We stretched (but should have broken) the public trust in our institutions. And we under invested in the commodities we need to live: energy, grain, water. So does raising interest rates fix this?

To the extent that loose monetary policy has led to speculation in commodities and artificially driven substantially higher prices than we would otherwise have? Yes.

To the extent that the influx of cash into the MBS and Treasuries to the tune of $120 billion a month artificially lowered interest rates and led to rampant increases in house prices? Yes.

But, we are short the things 7.8 billion people on planet earth need to live and thrive. Government intervention has created a global energy and food scarcity crisis built on a foundation of “micro emergencies that our egos feel like we need to solve.” Climate change and COVID fall directly in this category. I wonder if monetary policy does, too.

We have sanctioned Russian energy which is bankrupting Europeans for energy and it has reduced fertilizer production which makes food. This will disproportionately impact the poorest 2 billion people on planet earth that consume less energy than your fridge. Meanwhile, there are kids in school down the street that haven’t eaten meals outside of school for their lifetime and we care as little about them today as we did before “the latest crisis.” If interest rates are the only way to make Western wealthy countries consume FAR less and focus on what truly matters, then substantially higher rates will be required. But, at some point we have to stop reacting to fake emergencies because our response is killing us.

One final thought: The famine in Ethiopia in 1983 led to an estimated 1 million deaths out of 40 million people. That’s 2.5% of the population, presumably the poorest of the poor. While the global food crisis will have a disproportionate allocation of resources to the wealthier countries and people, by proxy, applying 2.5% across the 2 billion poor means 50,000,000 would die of starvation in the next 365 days. More likely, I don’t think it would be a stretch to say 2.5% deaths will apply to the global population, which would equate to 195,000,000 people.

Here we take a turn to biology. In rich countries, where stability, wealth and level of education has been a key factor in driving the low fertility rate in North America of 1.75 children per woman. In highly unstable environments, like Africa, the fertility rate is 4.2 children per woman. Which explains why, in Ethiopia post famine and despite 1 in 10 people being chronically food insecure, their population exploded post 1983 from 40 mm to 115 mm today.

Ironically, food insecurity is likely to make the global population grow at a much quicker pace, albeit those left will be, on average, poorer. And higher interest rates will exacerbate that.

Share this post