Technical Tuesday: Chesapeake Energy

In a special Technical Tuesday, we start with something I don't say very often: "brought to you by popular demand." I take on most issues: global warming; coronavirus over-zealousness; ESG lip-service; and how often I get fired. I write management teams open letters suggesting (nicely) how they could do their jobs better, suggest mergers and generally walk into every controversial subject I can find. But I really didn't want to take on Chesapeake. There is a lot to unwrap and it's a fluid situation. But, what #hottakenation wants, #hottakenation gets, and there were A LOT of requests for me to do this one. So here we go.

Founded in 1989 with an investment of $50,000, Aubrey McClendon and Tom Ward created the company that, if you could only pick one over the last 30 years, would be the one that exemplifies the industry (I'm hoping Lin Manuel Miranda writes the musical). It would go something like this:

How does a Belle Isle, Duke grad, son of a Joe

And a Oklahoman, dropped in the middle of a forgotten spot

In the Anadarko Basin by providence impoverished

In squalor, grow up to be a OKC hero and a baller? The $50,000 founding father with a father.... (you'll have to catch the musical to get the rest)

It's a tale of growth, bust, growth again, partnerships splitting, antitrust, margin calls, rebirth under a new flag and crashes (both figurative and literal). It has captivated everyone who has watched for as long as I can remember and in 2020, the drama continues.

Today, Chesapeake is a shell of the company they once were. Built for a natural gas price environment of $8/mcf, the collapse of NG forced the company's hand but hampered by debt, their balance sheet has exemplified why this is a crisis of balance sheets and what needs to be done to address it.

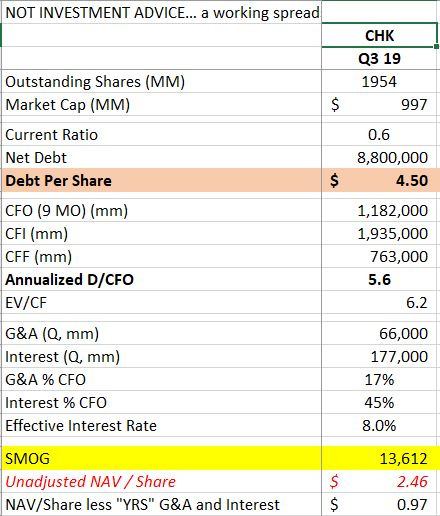

Let's start with the SMOG (as much as I hate to get ahead of the 2019 numbers but they are instructive). The 2020 adjustment estimates include the Wildhorse deal, closed February 2019 and the debt for equity swap in September 2019 as well as the $1.5 billion new debt to buy old debt at $0.70 on the dollar deal in December 2019). There is A LOT going on with this company so the numbers below are directional at best. Importantly, they issued a going concern warning in November 2019 which ... as you can imagine, is not good.

The YE2018 SMOG (recall at $62.04/bbl oil and $3.09/mcf gas) shows about a 1.5x coverage of their debt but also a 5.6x debt to cash flow from operations based on the annualized the Q3 number. Just look at the Q3 interest paid relative to cash flow. Ouch.

How about the assets? Amazingly, Chesapeake produces almost 4% of the natural gas in the United States. Becoming more oily or not, that's a lot of gas to manage when prices are $1.78/mcf.

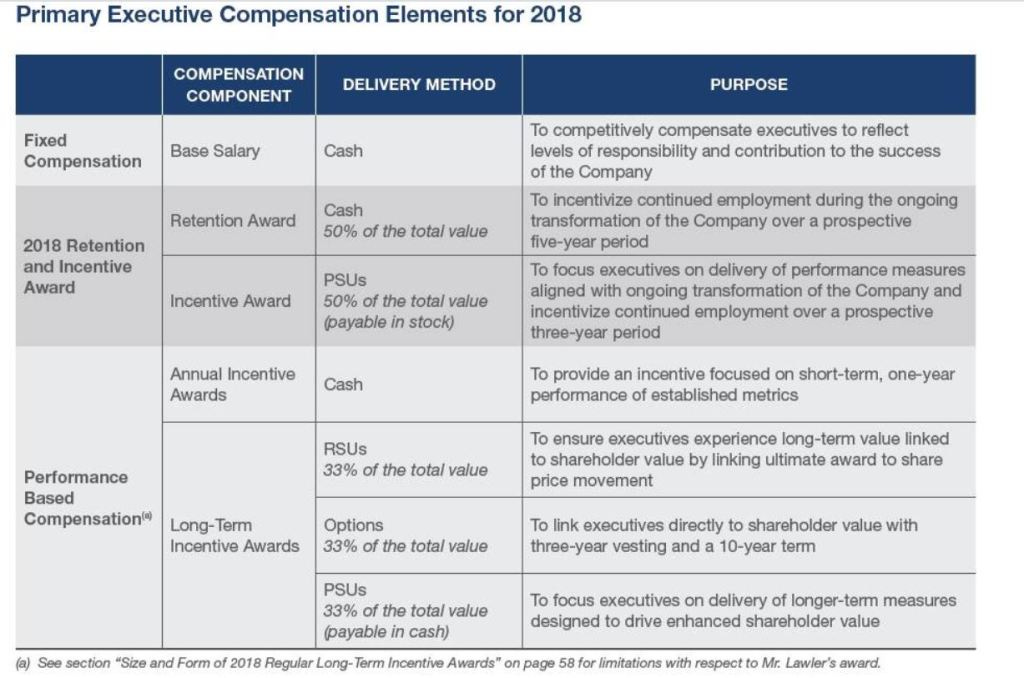

Enough with the data. If you are in the board room approving the 2020 capital budget and 2019 performance bonuses, what do you do? As you know, my view on the executive team at every company is that:

1) They and the board set the goals for their employees that should drive stock performance (and those employees should be paid). Targets for employees are good for them but management works for the shareholder. Full stop. If you set the goals right, the stock outperforms.

2) Executive compensation should be 90% in stock

3) At some point, the board needs to be accountable for the results, because ultimately, they approve the plan and represent the shareholders.

How'd we do?

Ummm. Not good. So you'd expect that the bonus for the 2018 performance year granted by the board to the CEO reflects that, right?

But at least it's all in stock and easy to understand.

So. Ah. Hmmmm.

Let me get this straight. The performance in 2018 was so good that 2019 was set up for long term success. So this year, they bought Wildhorse for (mostly) equity, converted debt to equity twice, issued a going concern warning, and the stock is down 75% since the beginning of 2019? I'm gonna go with What in the LITERAL F@&K is going on?

Look. At some point, there isn't any wizardry left. Oil is $49.60/bbl. Gas is $1.76/mcf. More debt to equity conversions? Stop drilling and completing entirely for 9 months and use all the free cash flow to pay down debt and see what happens? I am not usually at a loss for words, but I'm exhausted just thinking about it. Lin Manuel Miranda said it best: "I am not throwing away my shot...." but there aren't many bullets that haven't been fired. Except 1.

And that's why I'm not a shareholder (nor am I short) and I don't offer investment advice. But when bondholders are ready to get serious about governance, you know where to find me.