This morning, Devon Energy doubled down on the Bakken and acquired Grayson Mill for $5.0 Billion in cash and stock. Here’s the post I wrote about the deal when Equinor (Statoil) announced the divestment in 2021. It’s an interesting look back and shows just how well the Grayson Mill team did on it. In terms of timed acquisitions, buying during COVID has turned out to be an exceptional strategy.

Ugly Bakken babies

Equinor, formerly Statoil, divested their Bakken position today for ~$900 mm and brings to an end a 10 year foray into the basin, a position acquired for $4.4 billion. Ouch. With 48,000 boe/d of production and 242,000 acres... the metrics reflect what those trying to buy and sell deals already know. To get cash... prepare to have your face ripped off (as…

Like Ovintiv’s sale of their Eagleford to Validus and their subsequent win, this shows the perils of big public companies … generally. Sell low, buy high is generally not the path.

The trend of consolidation isn’t going away. As private equity has been taking their chips off the table and despite the death of the ESG wave, raising capital for the space isn’t what it was 10 years ago.

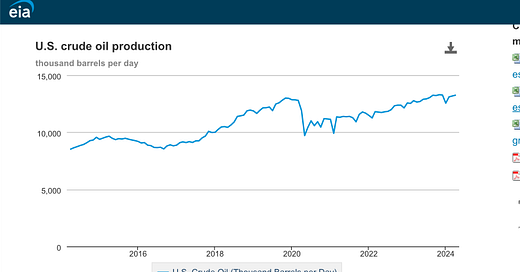

The big guys continue to get bigger, “more efficient” and high grade portfolios and I expect to see an incredibly active H2 of 2024. Oil and gas isn’t going away any time soon but the labor force will continue to shrink, assets will be held in tighter and tighter hands and at some point, international exploration and development is the only path forward. Nov 2019 and Apr 2024 production levels are effectively the same… and growth is getting harder and harder to achieve.

This may take Devon off the menu for gobble up