15 Days to Slow the Spread

Trump’s using the COVID playbook. But this time, the virus is capital addiction.

In 2020, Trump stood in front of the country and said, “We should be open by Easter.” You may recall (I sure do) that Fauci disagreed. The experts rolled out their charts, models, and lockdown plans. And the market tanked. Bill Ackman went on CNBC and said, “Hell is coming.” Days later, he made $2 billion.

Bill is back. Of course he is.

The country is 100% behind the president on fixing a global system of tariffs that has disadvantaged the country. But, business is a confidence game and confidence depends on trust.

President @realDonaldTrump has elevated the tariff issue to the most important geopolitical issue in the world, and he has gotten everyone’s attention. So far, so good.

And yes, other nations have taken advantage of the U.S. by protecting their home industries at the expense of millions of our jobs and economic growth in our country.

But, by placing massive and disproportionate tariffs on our friends and our enemies alike and thereby launching a global economic war against the whole world at once, we are in the process of destroying confidence in our country as a trading partner, as a place to do business, and as a market to invest capital.

The president has an opportunity to call a 90-day time out, negotiate and resolve unfair asymmetric tariff deals, and induce trillions of dollars of new investment in our country.

If, on the other hand, on April 9th we launch economic nuclear war on every country in the world, business investment will grind to a halt, consumers will close their wallets and pocket books, and we will severely damage our reputation with the rest of the world that will take years and potentially decades to rehabilitate.

What CEO and what board of directors will be comfortable making large,

long-term, economic commitments in our country in the middle of an economic nuclear war?

I don’t know of one who will do so.

When markets crash, new investment stops, consumers stop spending money, and businesses have no choice but to curtail investment and fire workers.

And it is not just the big companies that will suffer. Small and medium size businesses and entrepreneurs will experience much greater pain. Almost no business can pass through an overnight massive increase in costs to their customers. And that’s true even if they have no debt, and, unfortunately, there is a massive amount of leverage in the system.

Business is a confidence game. The president is losing the confidence of business leaders around the globe. The consequences for our country and the millions of our citizens who have supported the president — in particular low-income consumers who are already under a huge amount of economic stress — are going to be severely negative. This is not what we voted for.

The President has an opportunity on Monday to call a time out and have the time to execute on fixing an unfair tariff system.

Alternatively, we are heading for a self-induced, economic nuclear winter, and we should start hunkering down.

May cooler heads prevail.

Well, Bill. Your panic was wrong in 2020. And Trump was right. We should have been open by Easter, we’d have $10 trillion less debt and Trump never forgot. Now it’s 2025, and he finally gets to use the line the way he always wanted to.

“15 days to slow the spread.”

But this time, it’s not about a virus. It’s about leverage. About cheap money. About hedge funds, asset bubbles, and capital structures built on the assumption that America would never let markets feel pain again. That assumption just died.

This isn’t strategic ambiguity. It’s strategic trauma. Some to us. A huge amount to everyone else. He’s inflicting controlled demolition on global capital—forcing money out of risk and into Treasuries. Margin calls, forced liquidations, emerging market destruction. The whole thing. By design.

Bill, Bill, Bill… if you weren’t long bonds over the last few years getting beat by the market over and over, watching FOMO take hold and greed reign supreme, you weren’t paying attention. This isn’t Howard’s fault, it’s yours.

So now, three days in, as global markets spiral, hedge funds beg for bailout language, and every CNBC panel tries to make sense of floating tariff regimes and foreign policy smoke signals, Trump just watches. Because unlike in 2020, he’s the one pulling the levers. And he’s not doing it to calm things down. He’s doing it to discipline them.

Capital is the new virus.

It spreads fast, infects everything, and mutates into speculation, distortion, and fake growth. For 15 years, America has coddled it — ZIRP, QE, buybacks, bailouts. The Fed, Congress, Treasury — they’ve all fed the addiction. My favorite movie is The Big Short. Now it’s Trump himself delivering the detox. And just like COVID, it starts with fear and Bill on TV. Then comes paralysis. And finally capitulation.

All the economists, experts and hedge fund managers on TV weren’t advocating caution when the market ripped on horrible monetary policy, on $2 trillion deficits, on the U.S. government spending 30% of GDP and juicing the jobs report with public-sector hires. Why? Because they were making money. No one asked, “Wait, are we in a bubble?”

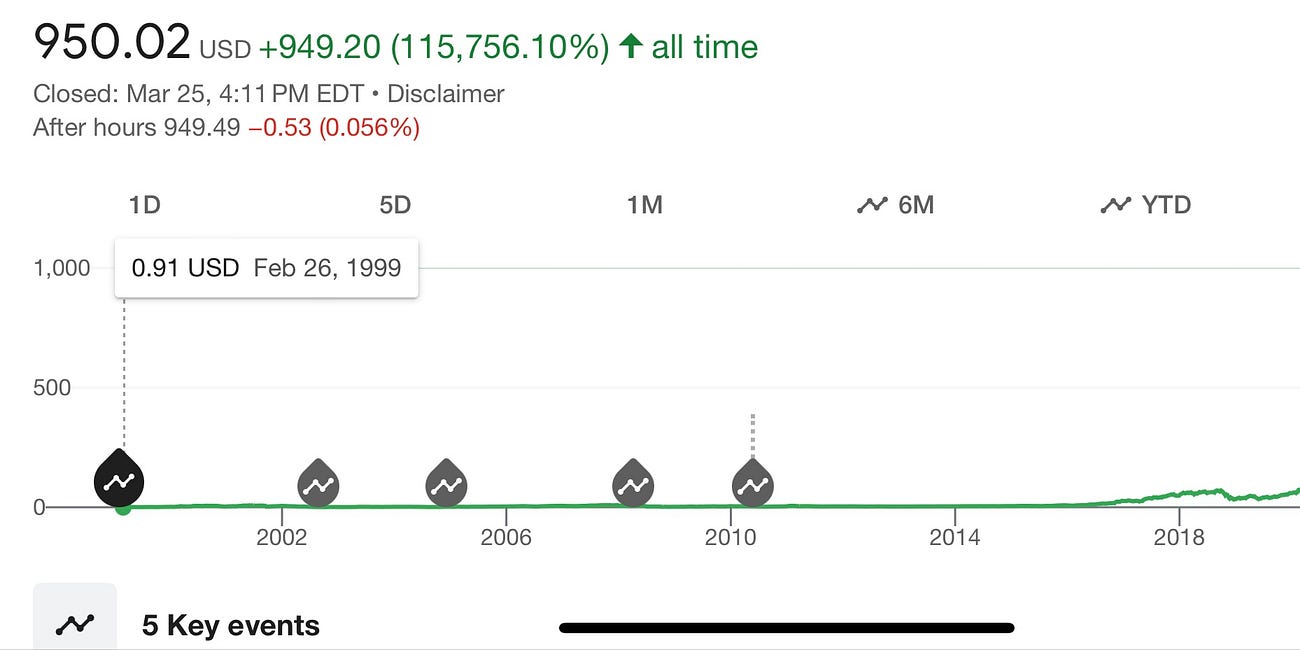

No one blinked when Tesla hit a trillion-dollar valuation.

When NVIDIA touched $3.5 trillion, they cheered — not because it made sense, but because their 401(k) went up.

Did these companies change the world? Yes. I absolutely love my Tesla and my Grok GPUs. But were the valuations loony-bins? Also yes. Just like Pets.com in 2000. Just like every hype cycle before. I wrote “this” last year and watched as it did nothing but go higher until DeepSeek ruined the party.

Nvidia. The new Tesla.

We haven’t done one of these in a while, and I must admit, I wish it was as easy the good old days of oil and gas annual reports. PVs. SMOG. Hedges. Firm transportation. Easy stuff to quantify. Inventory is relatively understood. Capital is predictable. Run it against a variety of price decks and boom, you discover as I did at the time that CDEV w…

Money managers became complacent. And Joe Normal? He used passive ETFs to auto-buy whatever stock the CNBC guest liked that week. He ignored historic P/E ratios. He forgot that wealth doesn’t come from stories. It comes from stuff.

Copper. Oil. Steel. Gas. Lumber. Land. Ships. Factories.

That’s where civilizations are built. That’s where power flows. Tech, by contrast, is about exit velocity —not permanence. Founders get rich. VCs rotate. And the average investor gets caught holding a meme stock with no cash flow when the music stops.

Unlike Bill, I’m not panicked. I advise (as a friend, because I can’t give financial advice, consult your expert warning here). Look at your portfolio and ask: which companies actually make something? Because the days of “buy anything with AI in the deck” are over.

Move quickly and break stuff

Trump is playing poker and he has all the cards. He has the trade deficit. He has the largest economic markets in the world. And he has a room full of cabinet secretaries that get it. First, he came for the government grift, life long jobs and NGOs making government actors rich and funneling that money into paid protests and climate change initiates (funny, haven’t heard a word about that in 70 days!). Now, he’s coming for the inflators, taking money on fees and pumping valuations because they had easy and risk free leverage. And the mission?

• Peace in Ukraine

Bombs in Iran

• Houthis gone

Venezuela crippled

• Hamas erased

Tariffs locked

• Capital disciplined

Dollar strong

• Industry home

Leverage purged

This is the plan.

It’s not pretty. It’s not polite. And it’s not pitched to investors who want stable assumptions and spreadsheet certainty.

Trump’s betting that after 15 days of chaos, markets will be begging for order. So will our trading partners. And as Bessent said in his interview, it’s not about the countries like Vietnam doing a deal, it’s the companies like Nike that offshored business there. Oh, yeah, and Ackman is very long Nike (11% if the fund and $1.2 billion of exposure … reminds me of his Hilton position in 2020).

So buckle up. It’s Day 3. Except this time, there’s no Fauci. No press conference. No soft landing. Only Trump. And only the message:

“We should be open by Easter.”

The markets changed pricing based on total hype and emotion - not based on company performance or company outlook. That should tell you everything you need to know about the stock market!! It’s buyer beware and do your research!!

Yes, but man-in-the-street-me is already suffering the increased tariff-price of Kevin Durant’s $79.99 newsletter which is now up to $3,339.79! I simply can’t afford not to pay the inflated newsletter fee as humanity and me depend on Durant’s insights to stop the spread of plant-life, the greatest existential threat to humankind in the form of O2 emissions which hollow-out NGO funding.